Setup (M)OSS Tax rules with Snelstart and Magento 2

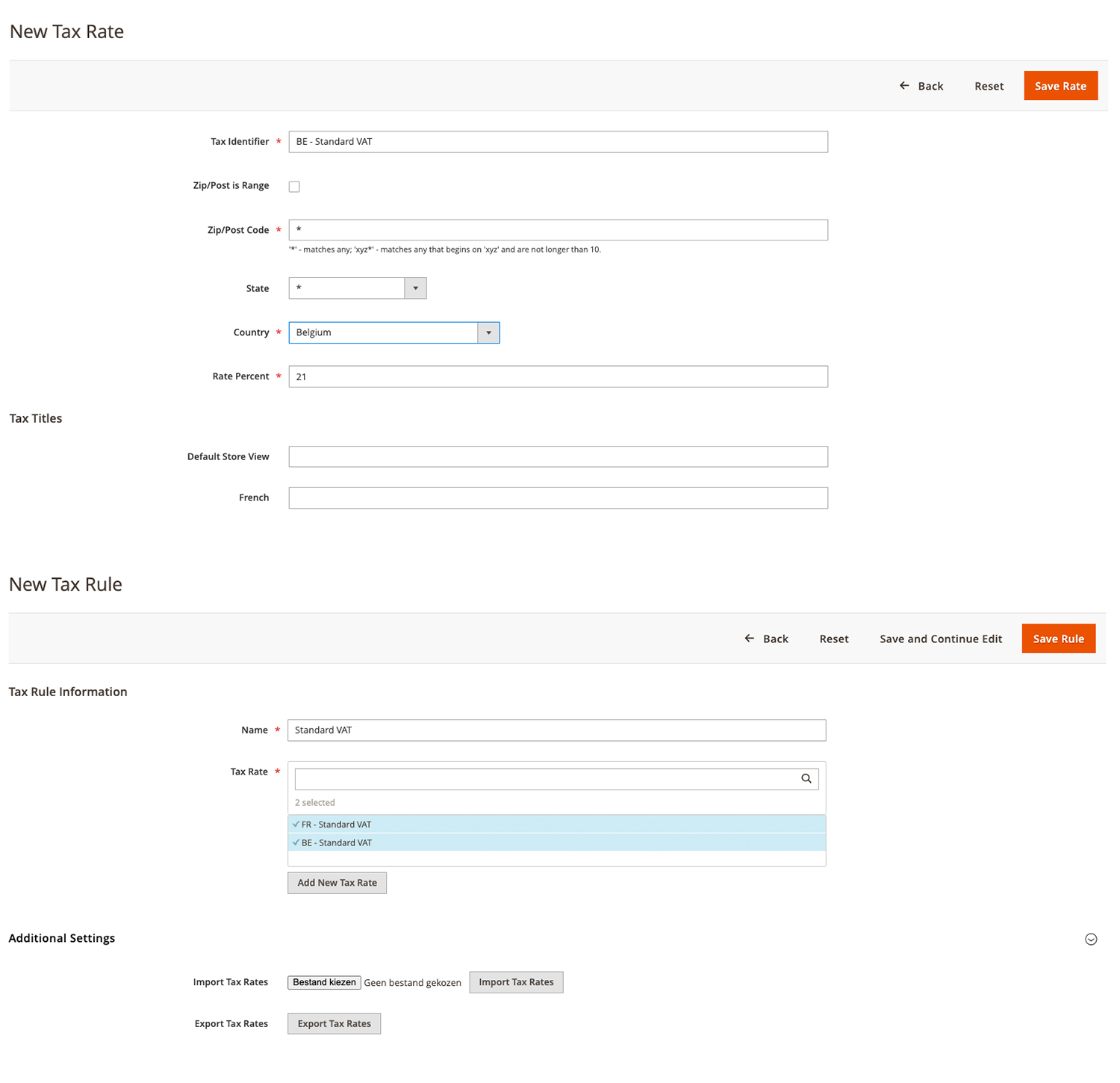

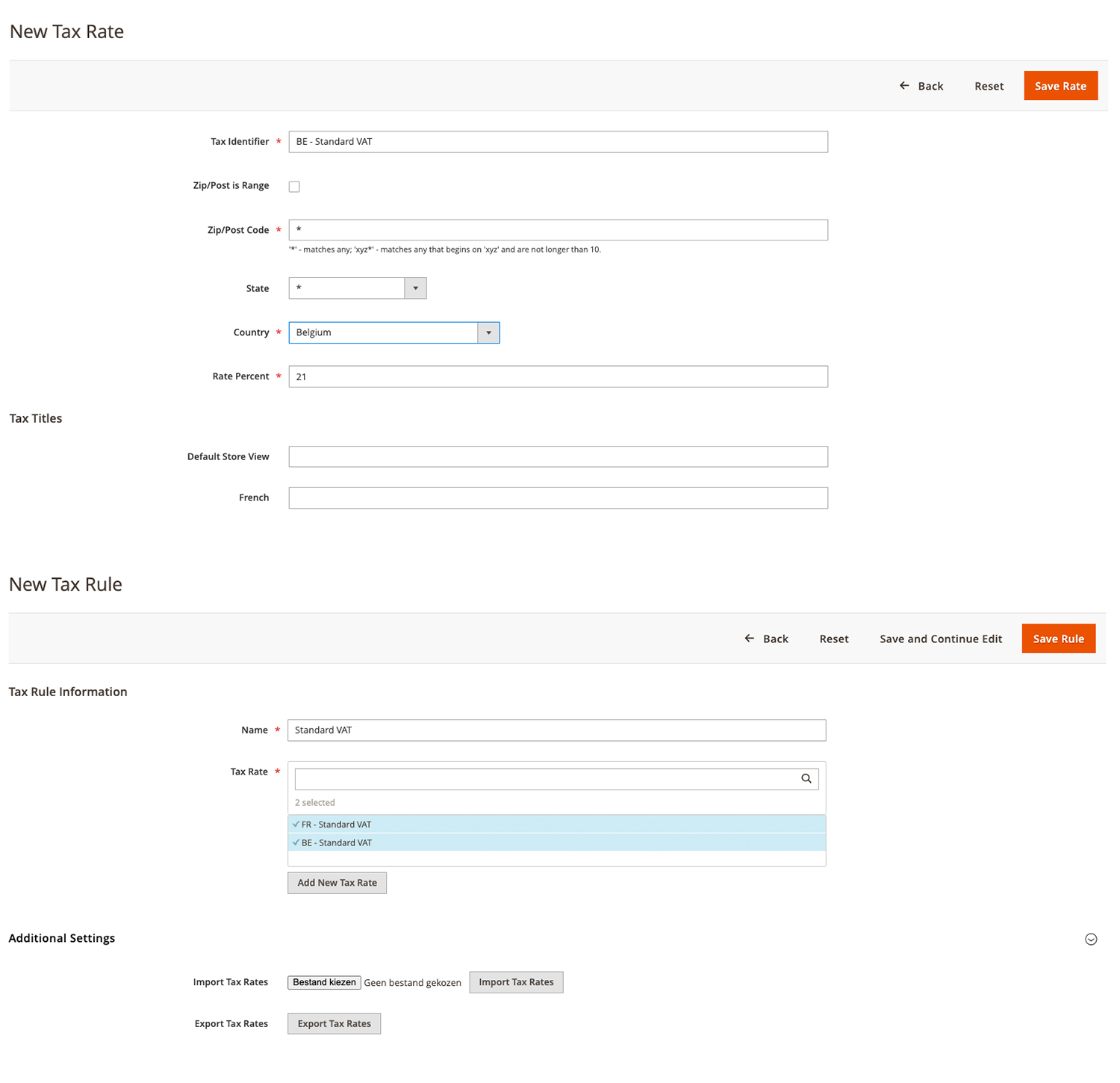

Now in Magento 2, all of the above countries must be added under Store > Tax Zones and Rates, whereby each country must be set with the correct local VAT rate.

After entering the zones, a new rule must be created under Store > Tax Rules to which all zones created above are added.

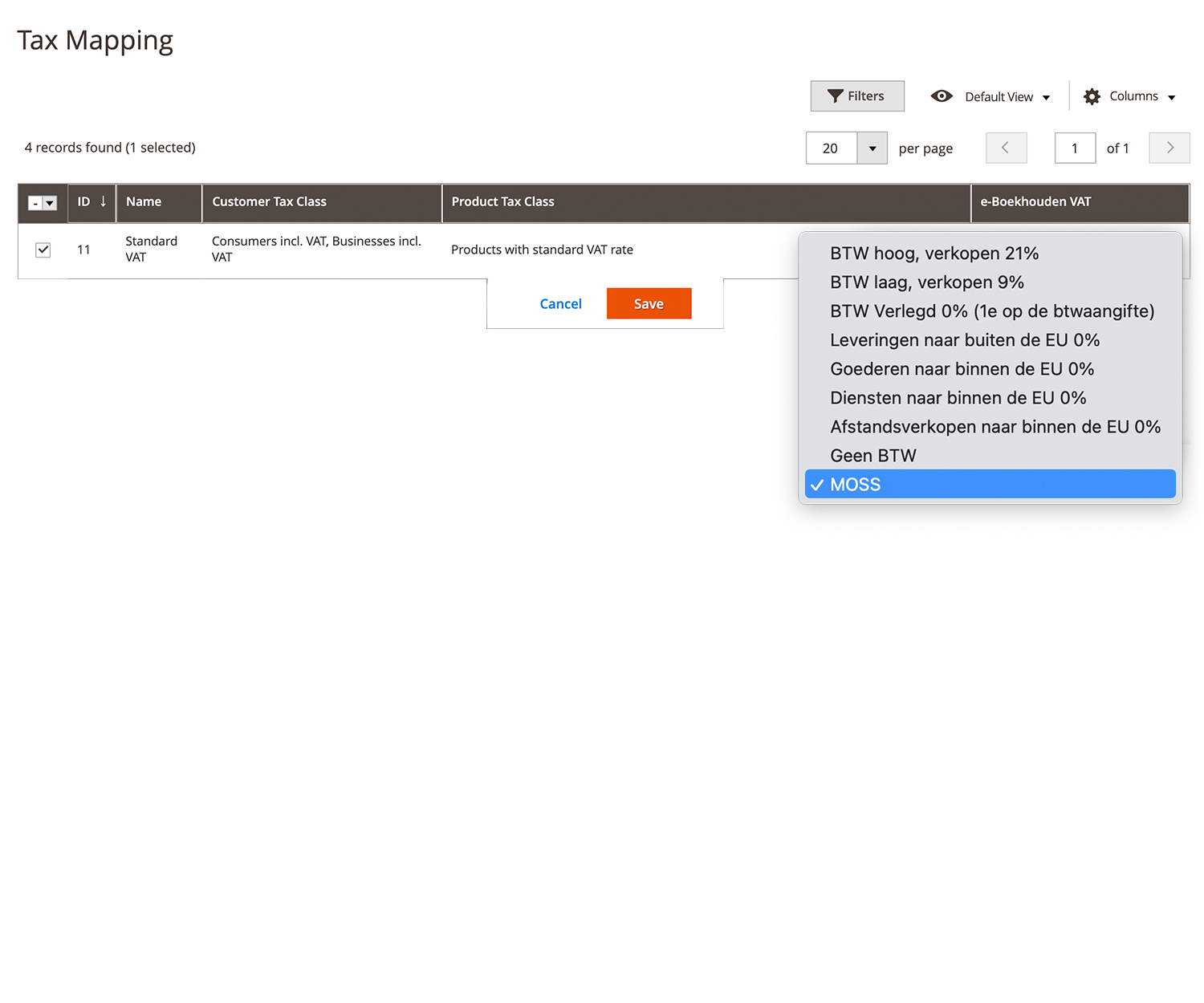

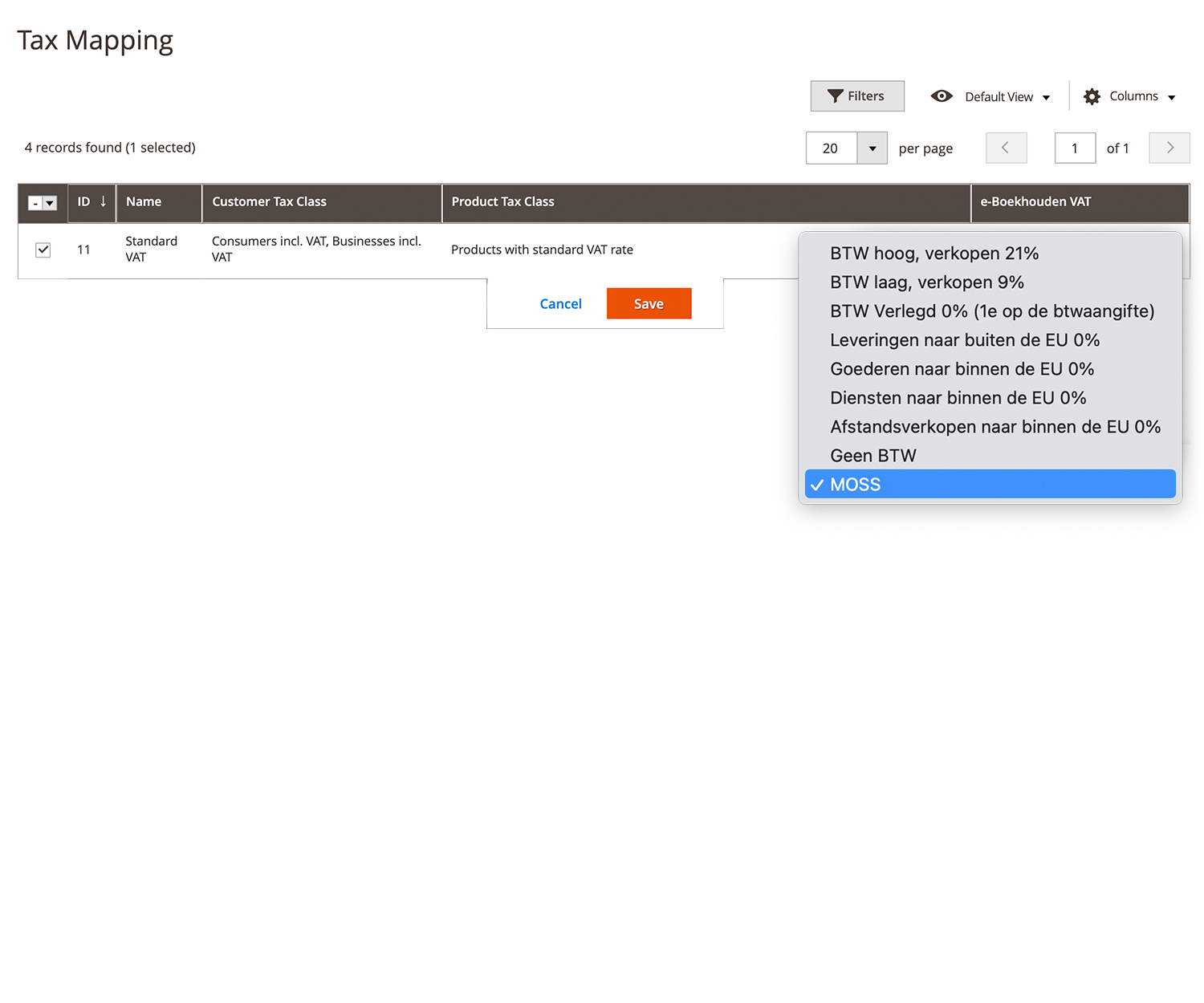

After creating this tax rule, navigate to Accounting > Tax Rate Mapping and map this new text rule to E-boekhouden VAT -> MOSS.

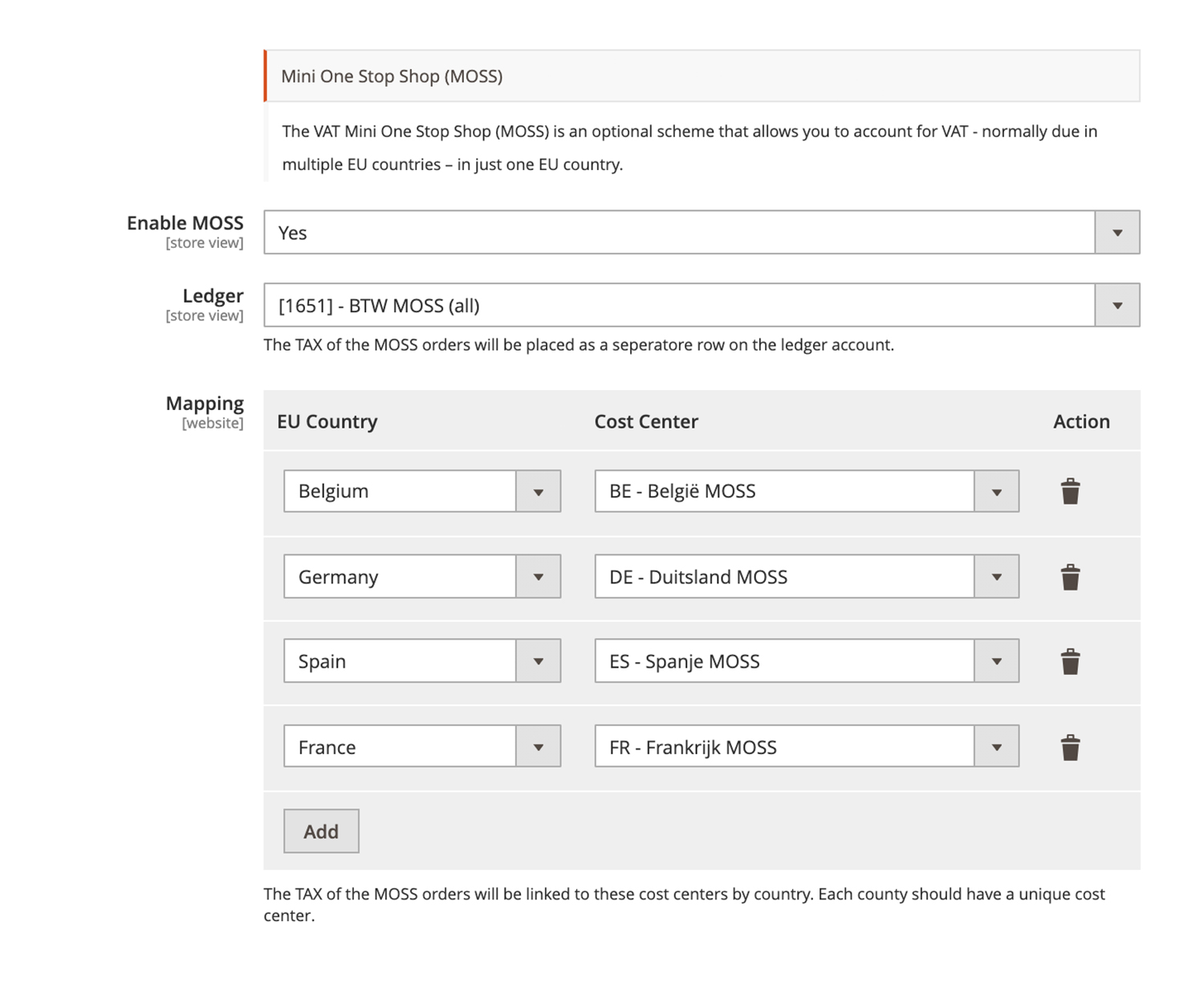

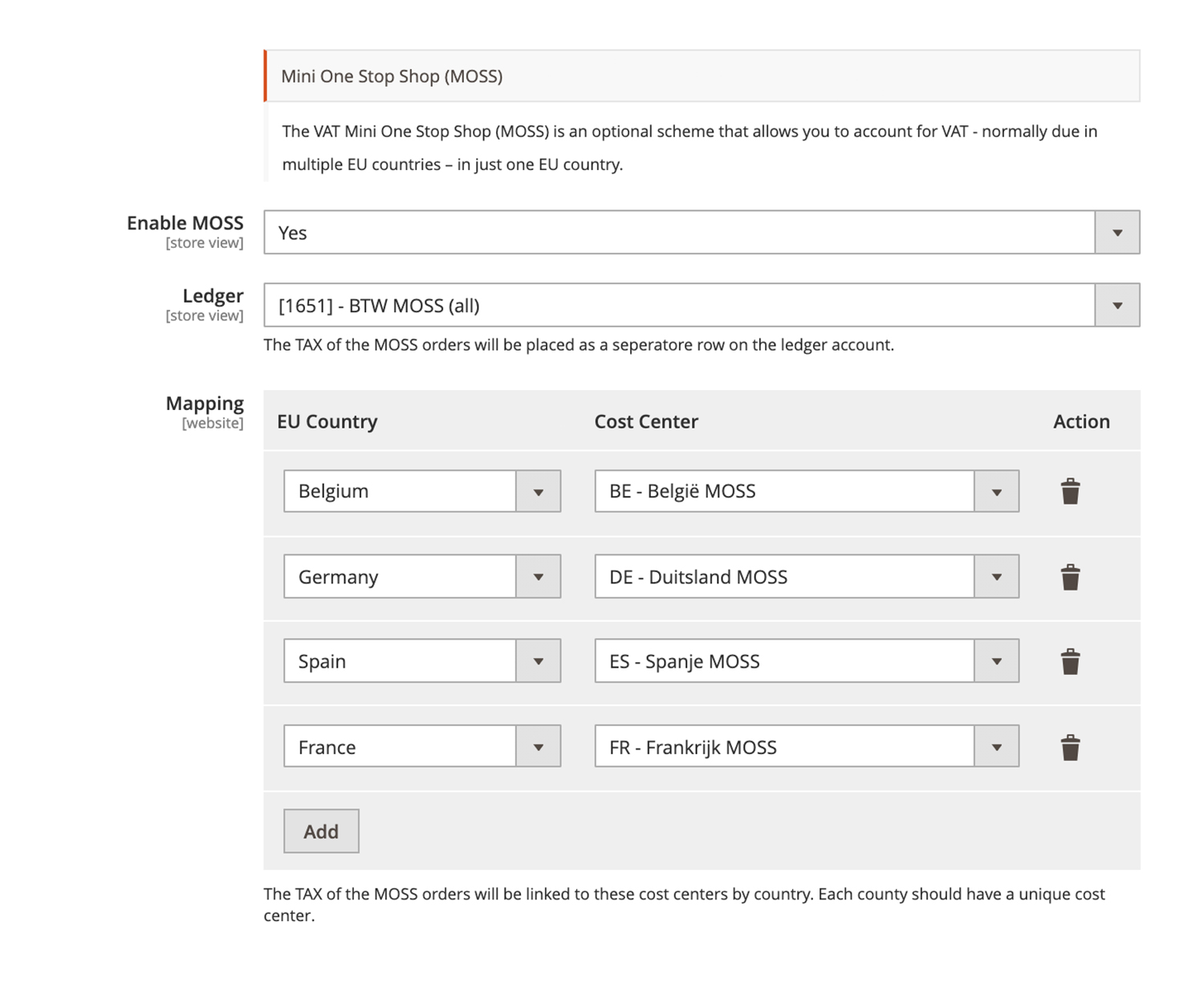

In Magento, navigate to Stores > Configuration > Accounting > E-boekhouden.

First, fresh the "cost centers" and "ledger account" bu using the button "Load info from E-boekhouden”.

Then under the heading Advanced Setting the MOSS should be switched on and the ledger account can be linked which was created in step 1, (eg [1651] VAT MOSS).

Finally, link the countries that are used to the newly created "cost centers" (for reference, see screenshot) and saves the configuration.

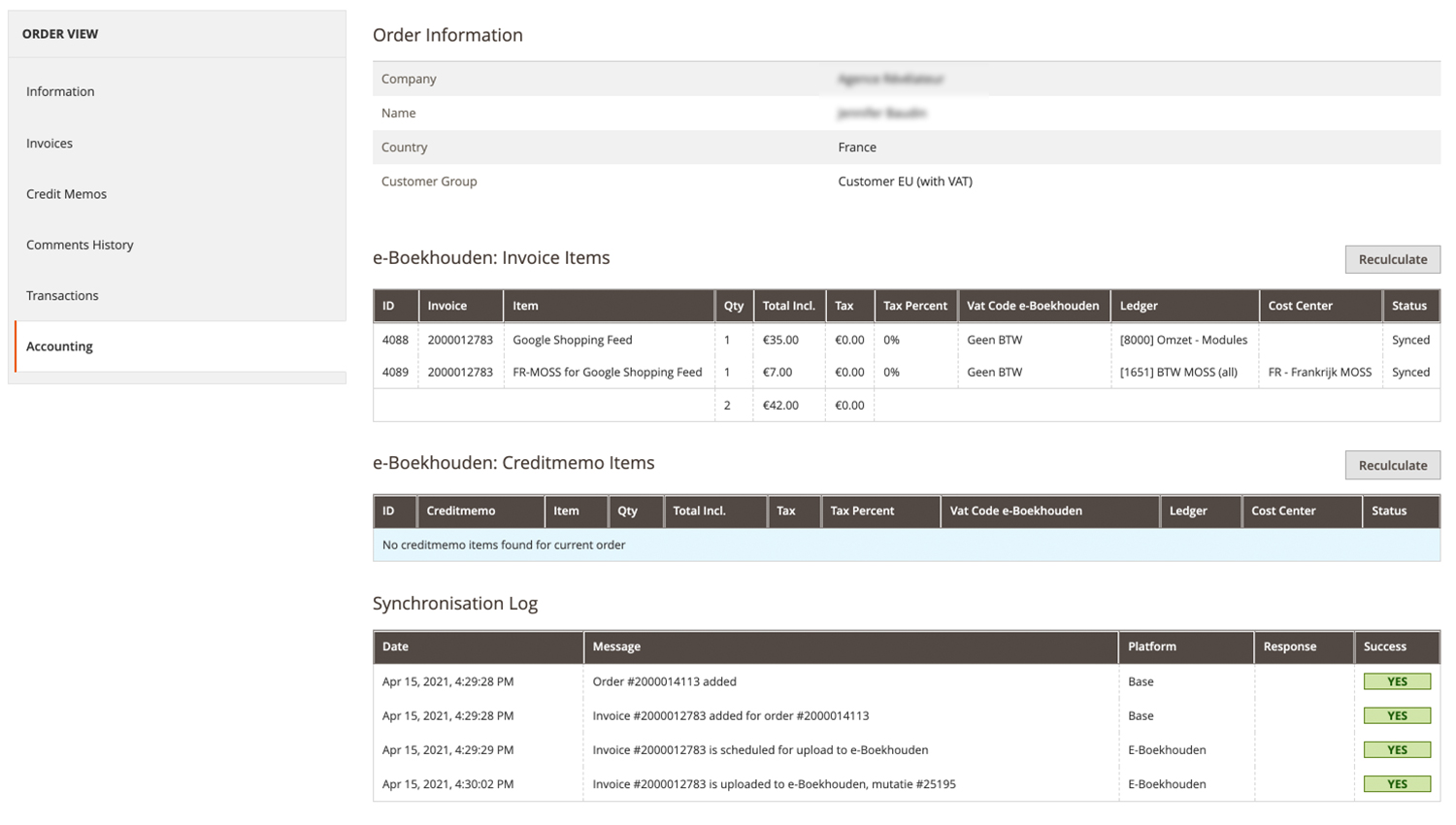

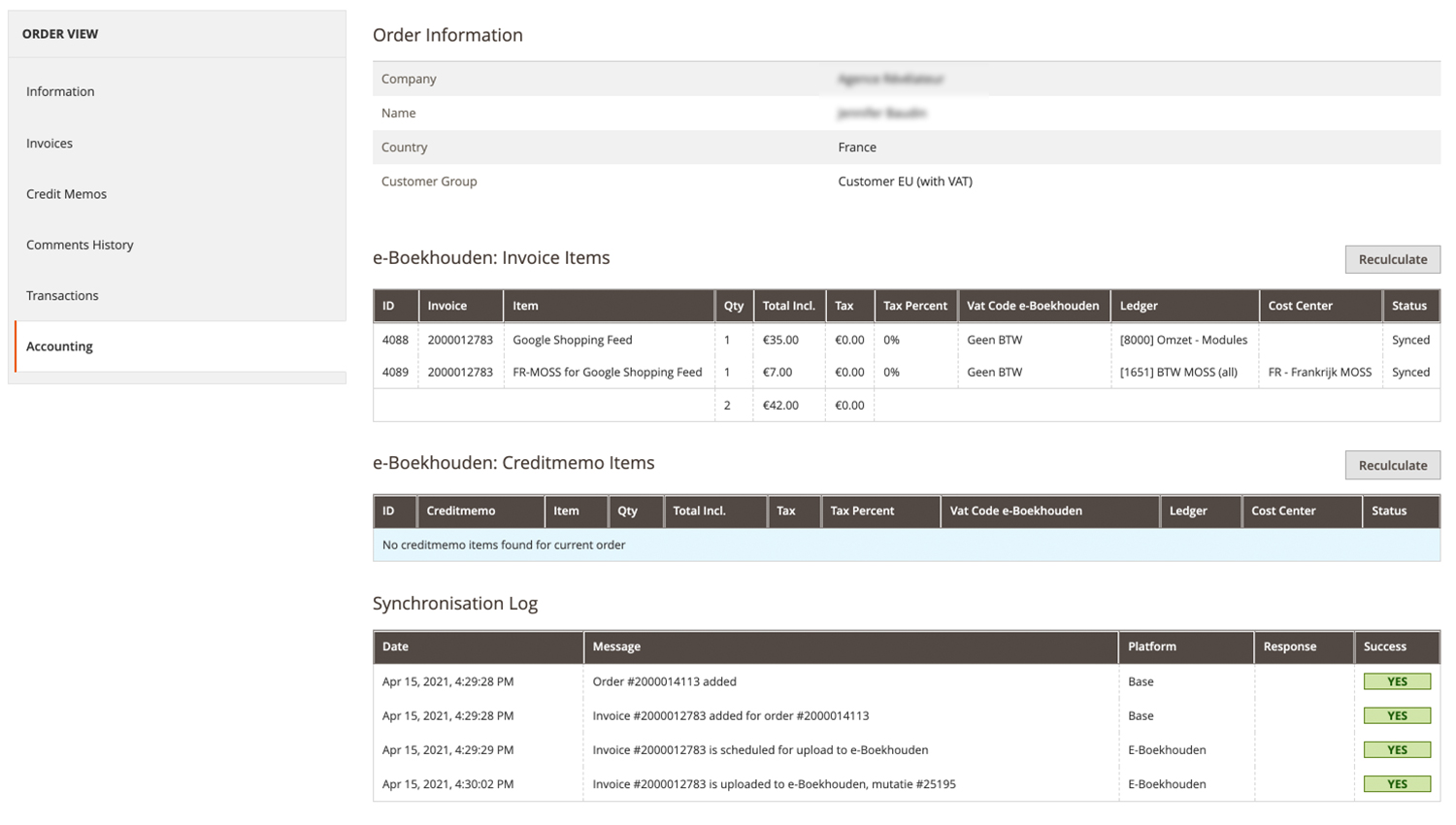

Once you've configured the MOSS settings successfully, you will notice the different invoice items with the right Ledger account in the accounting tab under a successfully placed order.

In this tab, you can perfectly overview the data that is synchronized with the E-boekhouden platform, together with the configured Ledger account en Costs center to make sure your MOSS configuration is saved successfully.